Here to help you

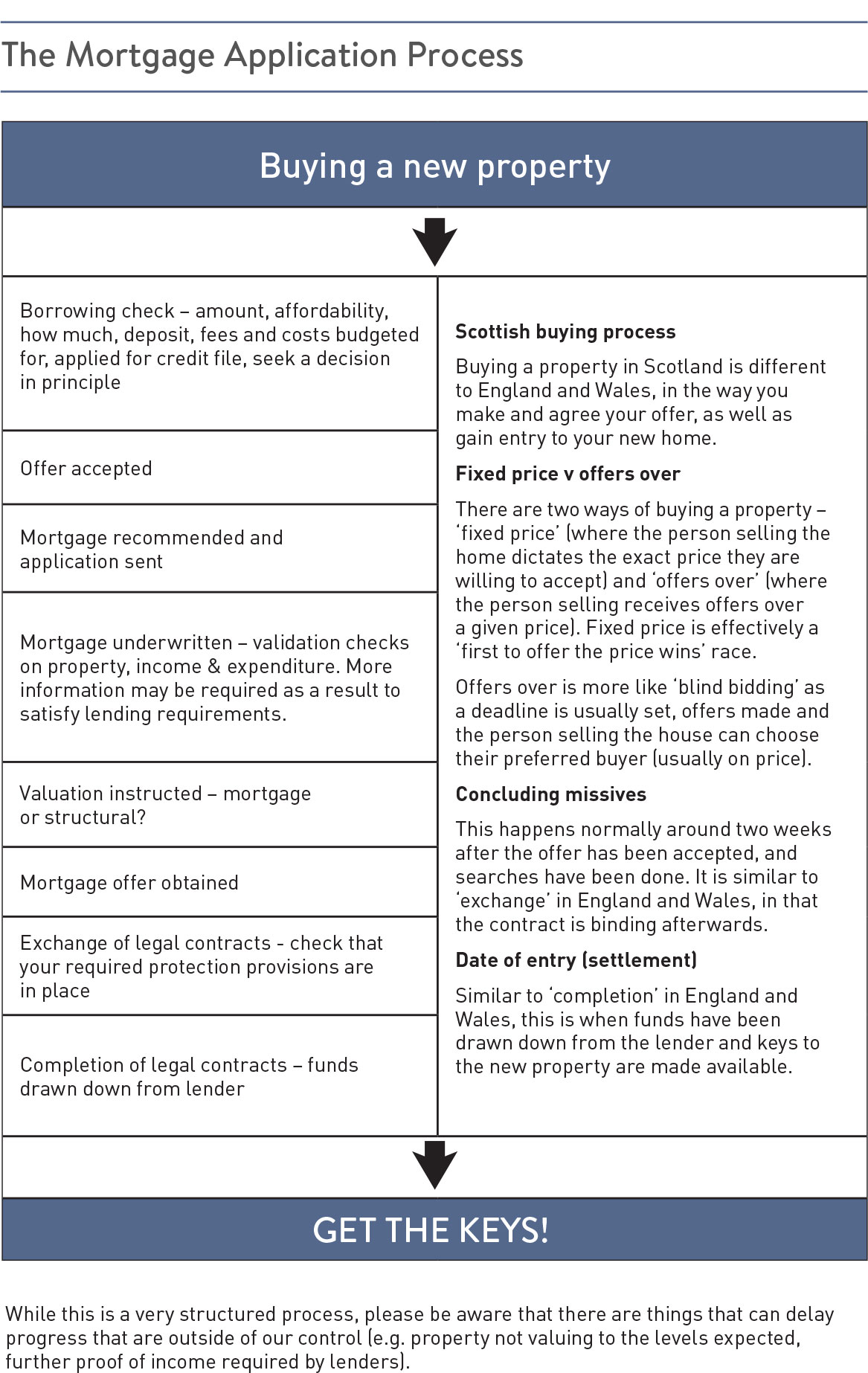

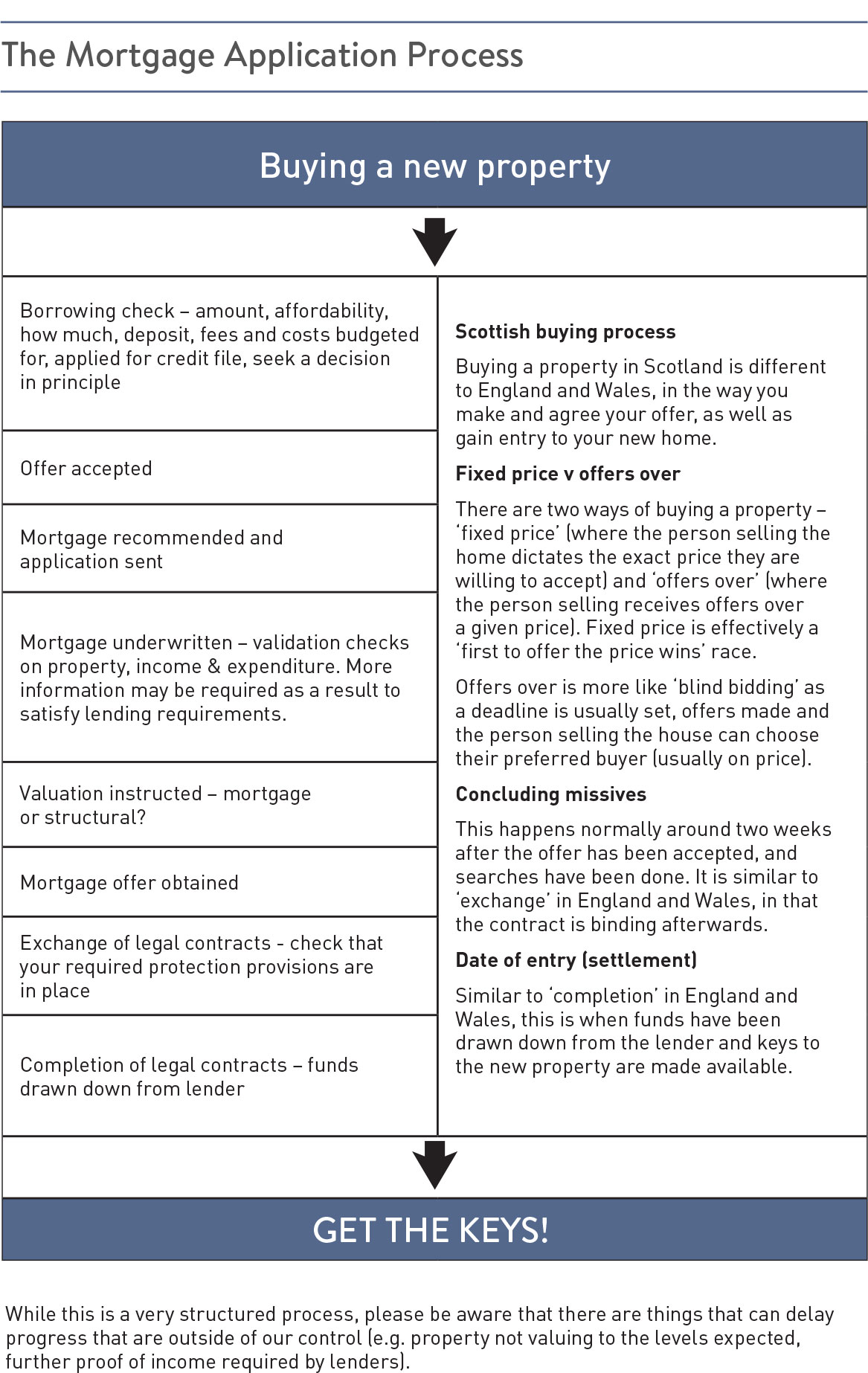

Buying your first or next home can be stressful. There are many questions you will need to ask yourself regarding your choice of property.

Then come the mortgage related ones such as:

- How much will it cost?

- Can I afford it?

- How much deposit will I need?

- What type of mortgage do I want?

- Will I get a mortgage?

The home loan market is complex. There are so many different mortgages to choose from.

So it’s good to know that, as your adviser, we are on hand to answer your questions. We will help you with the tricky process of not only getting a mortgage, but getting the right mortgage.

We take pride in offering a personal service that takes into account your individual circumstances. Your financial situation is unique, so we work hard to understand your goals and aspirations, and make financial recommendations based on a comprehensive and detailed analysis of your needs.

Our role is to:

- ensure you do not waste money unnecessarily by paying a higher monthly amount than you need to for your borrowings

- save you time and effort by recommending the most appropriate solution

- stop you missing out on the most cost effective way of arranging your loan.

CONTACT US

This communication does not constitute advice and should not be taken as a recommendation to purchase any of the products or services mentioned.

Before taking any decisions we suggest you seek professional advice.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.